Tiimely Own home loans

Let’s find your home loan

Save money, time and stress.

Variable

Tiimely own

Owner-occupied • Principal & interest

5.94%p.a.Interest rate

5.95%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Offset account optional for $10/month

- Fast approval with Tiimely Turnaround™

- Only 10% deposit required

- Unlimited additional repayments

- Up to 30 years loan term

$3,574Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Fixed 1 year

Tiimely own

Owner-occupied • Principal & interest

6.14%p.a.Interest rate

6.01%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to-rate after 1 year

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

$3,651Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Fixed 2 years

Tiimely own

Owner-occupied • Principal & interest

5.94%p.a.Interest rate

5.99%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to rate after 2 years

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

$3,574Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Fixed 3 years

Tiimely own

Owner-occupied • Principal & interest

5.94%p.a.Interest rate

5.98%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to rate after 3 years

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

$3,574Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Fixed 4 years

Tiimely own

Owner-occupied • Principal & interest

6.14%p.a.Interest rate

6.05%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to rate after 4 years

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

$3,651Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Fixed 5 years

Tiimely own

Owner-occupied • Principal & interest

6.14%p.a.Interest rate

6.06%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to rate after 5 years

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

$3,651Monthlyrepayments

Please note if you add an offset account, your comparison rate will change. Download your Key Facts Sheet

Our In-house Broker Service

Looking for something different?

Tiimely Own is the smart choice for a low-rate loan with fast approval, but it’s not for everyone. Our in-house broker service provides major bank loans and supports complex situations and loan features such as split loans, guarantor loans, and construction loans.

Home loans made simple, with a human touch

Low-stress home loans with easy online approvals.

Local experts

If you get stuck or have a question, our local team of home loan experts are available, in seconds.

Real transparency

No surprises, no hidden fees. Just clear and simple to understand info, fast.

Knowledgeable support

Our brokers don't work on commission. They're here to find the right loan for your needs, not ours. Read more.

Security matters

We take security very seriously here at Tiimely Home. Our platform technology is so secure it's licensed by two of Australia's biggest banks.

What’s the catch with the low rates?

There's no catch. Thanks to our own tech, we're able to assess home loan applications much faster than the average lender. So with Tiimely Own home loans, we can pass on savings to customers via consistently low rates in market.

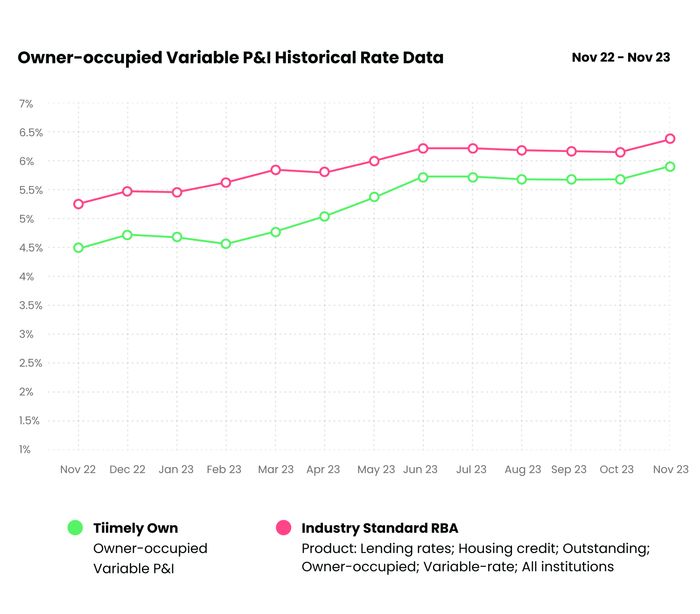

The rate graph shows Tiimely Own owner-occupied variable interest rates against outstanding owner-occupied variable rates for institutions as provided by APRA, RBA. Product features may differ across products. Rate comparisons exclude any costs and fees. Every borrower’s situation is different. Data is accurate as of 24-Jan-2024.

Tiimely own home loans

There's more to love than just low rates

Our award-winning home loans are packed with all the essential features.

Secure, bank-backed offset

We’ve partnered with one of Australia’s biggest banks to give you a 100% offset account that’s fully government guaranteed.

Tiimely Turnaround™

Get approved faster with Tiimely Own home^. Our record for assessing and approving a home loan - with a contract – is less than 58 minutes from the time of application.

No hidden fees

Our fees are simple and transparent, so you'll always know what to expect. $0 Upfront fees, $0 Monthly Fees (excludes offset), $0 Application Fee, $0 Annual Fees.

Fixed-rate with offset

Unlike most other lenders, we offer a 100% offset account for both our fixed and variable home loans so you can save on interest.

Free redraws

Make extra payments on your loan and reduce your interest, then easily access funds at a later date if you need cash.

Same low rate with a 10% deposit

With Lenders' Mortgage Insurance (LMI), you can borrow up to 90% and get the same great rates.

Local experts

Talk to a local home loan expert

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

Our calculators

Explore your borrowing power and more

Repayments calculator

Find out what your repayments could be and check if it's within your budget.

Borrowing Calculator

Get an upfront estimate of your borrowing power.

Refinance calculator

Not sure how your rates compare? Find out how much you could save by refinancing.

Stamp duty calculator

Understand the upfront costs involved with buying a home.

Have questions? We have answers

I'm self-employed, can I apply for a Tiimely Own home loan?

es, absolutely. It’s the same application for all home loan variations however there are some eligibility requirements you’ll need to prepare:

- provide your registered ABN

- have been self-employed for at least 1 year

- provide your most recent business tax return AND your most recent personal tax return together with the notice of assessment

- be registered for GST If your turnover is more than $75,000p.a.

- have a good credit history

- meet our standard eligibility criteria

Note: Financial validation requirements – Tiimely Own home loans require a years' worth of up-to-date tax returns or business financial statements.

The only difference as a self-employed person compared to a PAYG customer, is that we won’t be able to instantly validate your income by linking your bank accounts.

Instead, you’ll need to upload your business financial statements and tax returns, as well as your personal tax returns and notice of assessment. Then one of our team of Credit Assessors will review them to assess your application. It’s not as fast as our tech, but you’ll still get an answer much faster than your average lender, because they're only checking the parts of your application that our tech couldn't.

Learn more about applying as a self-employed applicant here.

Why are your rates so low? What’s the catch?

There is no catch, we just have a simpler, better way for customers to get a home loan.

Our Tiimely Home application is different to traditional applications. It’s not a manual form that you fill out digitally, but a live application that assesses your information and eligibility in real time.

It’s because of this efficiency in our process that we’re able to offer some of the best interest rates in the market.

What does it mean to be bank backed?

Is Tiimely Home a bank?

No, we’re not a bank. But we’re backed by a trusted bank.

So what does that mean?

Tiimely Home has the backing of Bendigo and Adelaide Bank; they fund our home loans, provide our offset accounts and importantly, giving our customers the protections a bank has in the unlikely event of a finance crisis. Read our guide on the Financial Claims Scheme (FCS) and why it's important that our offset accounts are covered under the FCS for up to $250,000.

Our agreement with them to fund our Tiimely Own home loans means that when you get a Tiimely Own home loan, any funds we loan you come from Bendigo and Adelaide Bank .

Our proprietary tech that powers our application process, is so efficient at assessing customers for a home loan, that we get market-leading pricing on the bank funds. This means we can offer customers bank-grade products but with low rates and no hidden fees.

Bendigo and Adelaide Bank has been our partner since our early days and continue to be an important shareholder and invested in our future.

Why does Tiimely Home need a bank partner?

Partnering with a bank enables us to:

- reduce our overhead costs and offer lower interest rates

- focus on tech innovation for the home loans industry

- combine the best features of a bank (like offering an offset account) with the best features of a Fintech (100% online application).

Do you have an offset account and how does it work?

An offset account is like a savings account that’s linked to your home loan which offsets the balance of your home loan. It offsets the balance of your home loan so you only pay interest on the balance minus the amount in your offset. The larger the balance in your offset account, the less interest you pay on your home loan. This could potentially save you thousands in interest over the life of your loan.We offer 100% offset accounts with all our Tiimely Own home loans, including our fixed rate loans. You can find more information on our offset account here.

Can you withdraw money from an offset account?

An offset account has most of the features of a normal transactional savings account. You can deposit money and withdraw from it any time to pay bills or for day-to-day expenses. However the more you have in your offset, the less interest you’ll pay.

Your money is protected

Your offset account is managed by our funder, Bendigo and Adelaide Bank, an Authorised Deposit-Taking Institution (ADI). This means your offset account is guaranteed under the Australian Government's Financial Claims Scheme (FCS) for up to $250,000.

Tiimely Own offset accounts

Unlike some other lenders, at Tiimely Own we don't build the cost of the offset account into our interest rate. You simply pay $10 per month for the feature.

Our offset accounts include;

- A Tiimely Own VISA Debit card which you can use like any other VISA Debit or EFTPOS card. Any Suncorp or Bendigo ATM usage is free of charge

- A BPAY facility for bill payments and a swipe option for retail transactions

- Deposit and debit features like any standard bank account

Adding or removing offset account

If you change your mind, after you get your home loan, you’ll need to pay a fee of $150. And if you're on a fixed interest rate, an additional break cost will also apply.

To add or remove an offset account, give us a call on 08 7109 9010 or email myloan@tiimelyhome.com.au and we’ll make the change for you.

Learn more about offset accounts, and how they differ from redraw facilities.

How long does it take for a home loan to be approved?

We’re known for our fast approval times, with our online application taking about 15 minutes to complete. However, the time to approval depends on the complexity of your application and the number of applications we're processing at the time.

Our fastest fully approval - from the time the application was submitted (including assessment, verification, and running all our digital checks) is 58 minutes however, approval times depend on individual circumstances.

Once you’ve completed the application process, you’ll either be approved, politely declined, or referred to one of our home loan experts to fill in any blanks or to get more information to enable your application to be assessed.

We’ll also let you know if we’re experiencing any delays and once we pick up your application for assessment, we immediately start working towards approval. The quicker you’re able to respond to any requests from our Credit Assessors, the quicker we’ll be able to fully assess your application.

Our application is entirely online.

We believe in removing the complication associated with getting a home loan and reimagined home loans from the ground up, simplifying the process and making it more efficient and easier to understand.

If you're approved, you'll get an email from us detailing the next steps, along with your home loan contract. You’ll also get a settlement pack which will outline further steps.

What may delay my home loan approval?

Sometimes delays occur if we need more information. Opting to validate your financials manually instead of securely linking your accounts slows the process down significantly, and one of our Credit Assessors will need to assist. Submitting an incomplete application or providing inaccurate estimates of your expenses (or any information regarding your income, expenses and debts) also requires manual work from our Credit Assessors, so make sure you’re really ready before you apply.

Due to our competitive rates, we often receive large volumes of applications, and it takes us a little longer than usual to assess and approve your application. When this happens, we’ll be sure to let you know as soon as possible. We work hard to keep up with demand and are continually growing our team to ensure we maintain our fast approval times.

If your application is time-sensitive or if there is a deadline you’re trying to meet, please speak with our team to get an understanding of our current approval times. You can chat with us over LiveChat or on 1300 842 405.

What happens if my application needs to be reviewed by a Credit Assessor?

If we need more information, we’ll refer your application to one of our Credit Assessors who’ll help you complete your application. Our Credit Assessment team move fast, and if you’re proactive in responding to their requests, they’ll be able to process your application quickly.

Sometimes they’ll only need one or two things like updated payslips or a bank account statement. Everyone’s situation is unique, so if your specific application is more complex than most, you might be asked to provide more detail. If you’ve chosen to validate your financials manually, this typically requires more information and your application will take longer to assess, however if you choose digital validation, our team receive the exact same information, but much faster.

If you’re ready to try a better way to do home loans, you can start the application process here.

Other information

Repayment amounts

Our monthly repayment estimates are based on the product you've chosen, the loan amount, as well as the property value you've entered, calculated over a 30-year loan term.