We do loan, you do home.

Get the right home loan, and save thousands.

Variable

Tiimely own

Owner-occupied • Principal & interest

5.94%p.a.Interest rate

5.95%p.a.Comparison rate

Our panel of lenders

Faster approvals

One online application gets you the right home loan, fast.

Expert service

Our Australian-based, expert team takes the stress out of getting a home loan.

Exclusive low rates

Access our Tiimely Own home loan rates - not available via any bank or broker.

Tiimely Own

Award-winning online home loans

Find some of Australia's best interest rates.

Variable

Tiimely own

Owner-occupied • Principal & interest

5.94%p.a.Interest rate

5.95%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Offset account optional for $10/month

- Fast approval with Tiimely Turnaround™

- Only 10% deposit required

- Unlimited additional repayments

- Up to 30 years loan term

Please note if you add an offset account, your comparison rate will change.

Fixed 1 year

Tiimely own

Owner-occupied • Principal & interest

6.14%p.a.Interest rate

6.01%p.a.Comparison rate

- Offset account optional for $10/month

- 5.99% roll-to-rate after 1 year

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

Please note if you add an offset account, your comparison rate will change.

Variable

Tiimely own

Investment • Principal & interest

6.29%p.a.Interest rate

6.29%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Offset account optional for $10/month

- Fast approval with Tiimely Turnaround™

- Only 10% deposit required

- Unlimited additional repayments

- Up to 30 years loan term

Please note if you add an offset account, your comparison rate will change.

Fixed 1 year

Tiimely own

Investment • Principal & interest

6.24%p.a.Interest rate

6.29%p.a.Comparison rate

- Offset account optional for $10/month

- 6.29% roll-to-rate after 1 year

- Fast approval with Tiimely Turnaround™

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- Only 10% deposit required

- Up to 30 years loan term

Please note if you add an offset account, your comparison rate will change.

Real customers, real savings

See what satisfied Tiimely Home customers (formerly Tic:Toc) say about us on Trustpilot.com

Shop with confidence

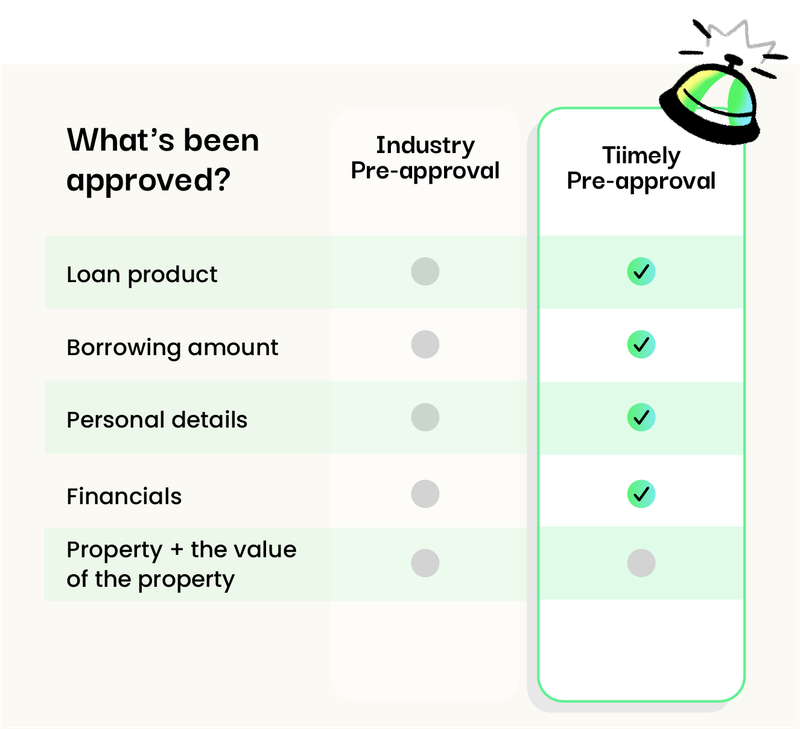

Unlike most lenders, our pre-approval is not simply an indication of what you might be able to borrow. Our pre-approval for our Tiimely Own home loans is everything we can assess without knowing your property. Which means you can plan, budget, inspect and shop with confidence.

Local experts

Talk to our local home loan experts

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

Frequently asked questions

Have questions? We have answers

Getting a home loan is an important decision, so it's natural to have questions.

Why are your rates so low? What’s the catch?

There is no catch, we just have a simpler, better way for customers to get a home loan.

Our Tiimely Home application is different to traditional applications. It’s not a manual form that you fill out digitally, but a live application that assesses your information and eligibility in real time.

It’s because of this efficiency in our process that we’re able to offer some of the best interest rates in the market.

What does it mean to be bank backed?

Is Tiimely Home a bank?

No, we’re not a bank. But we’re backed by a trusted bank.

So what does that mean?

Tiimely Home has the backing of Bendigo and Adelaide Bank; they fund our home loans, provide our offset accounts and importantly, giving our customers the protections a bank has in the unlikely event of a finance crisis. Read our guide on the Financial Claims Scheme (FCS) and why it's important that our offset accounts are covered under the FCS for up to $250,000.

Our agreement with them to fund our Tiimely Own home loans means that when you get a Tiimely Own home loan, any funds we loan you come from Bendigo and Adelaide Bank .

Our proprietary tech that powers our application process, is so efficient at assessing customers for a home loan, that we get market-leading pricing on the bank funds. This means we can offer customers bank-grade products but with low rates and no hidden fees.

Bendigo and Adelaide Bank has been our partner since our early days and continue to be an important shareholder and invested in our future.

Why does Tiimely Home need a bank partner?

Partnering with a bank enables us to:

- reduce our overhead costs and offer lower interest rates

- focus on tech innovation for the home loans industry

- combine the best features of a bank (like offering an offset account) with the best features of a Fintech (100% online application).

What is an online home loan?

It’s a home loan, but via a completely digital, online process.

At Tiimely Home, our world-first technology gives you the freedom to apply online for a home loan anytime, anywhere and in under an hour, which is a very different experience to applying through a bank or other brokers.

Our process is more than just a digital form you fill out, in fact we’ll assess your application and verify your information as you fill it in, in real time.

Our self-serve home loan application can be completed independently and at your own pace, but, if you’d prefer to speak with someone at any stage of the process, or you’d like a little help, you can contact us via LiveChat, phone, or email and we’ll support you through the process.

Find out more about Tiimely Home and how we do home loans differently, here.